Infographic: Medicaid Surety Bonds

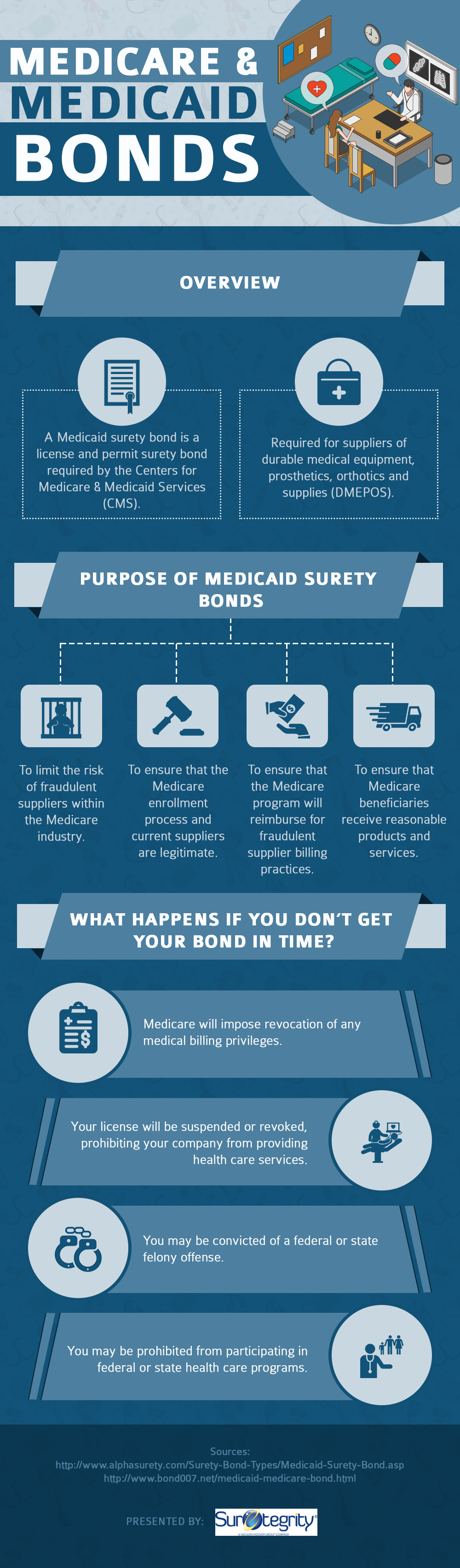

The infographic, “Medicare and Medicaid Bonds,” describes the purpose of Medicaid surety bonds and what could happen if you don’t get your bond in time.

A medical surety bond is a license and permit surety bond required by the centers for Medicare and Medicaid services (CMS). It isrequired for suppliers of durable medical equipment, prosthetics, orthotics and supplies (DMEPOS).

Medicaid surety bonds help to limit the risk of fraudulent supplies within the Medicare industry and ensure that the Medicare enrollment process as well as supplies are legitimate. Additionally, the bond legally requires Medicare programs to reimburse for fraudulent supplier billing practices. Ultimately, these types of bonds ensure that Medicare beneficiaries receive reasonable products and services.

Getting your bond in time is very important because if you don’t, your license will be suspended or revoked, prohibiting your company from providing health care services. For more information, refer to the infographic below.

Leave a Reply